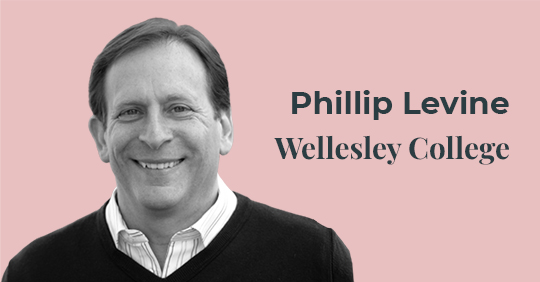

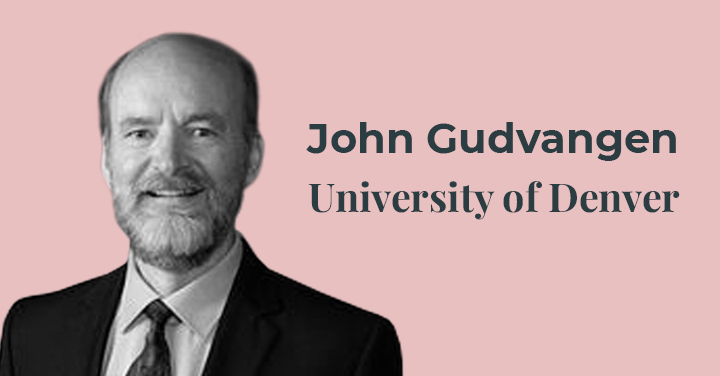

We know families have a lot of questions about financial aid. And the earlier you get answers the better. We recently spoke with two top colleges to get expert insight into the financial aid process.

Tom McDermott is the Associate Vice Provost for Financial Aid at Johns Hopkins University, joined by Mike McLaughlin, Director of Financial Aid at Middlebury College. We cover the basics plus important factors to know before and after you apply for financial aid.

1. What are the types of financial aid and how do families start applying?

Mike: Families should always start with the Free Application for Federal Student Aid, referred to as the FAFSA. Completing this application will let students know what types of federal aid they’re eligible for, like Federal Pell Grants, the Federal Supplemental Educational Opportunity Grant, Federal Work Study and direct loans.

A lot of private schools, like Middlebury, require an additional financial aid application, most often the CSS Profile. Schools use this form to determine eligibility for institutional aid.

Financial aid generally comes in three main forms:

- Work study, through federal or institutional funds

- Federal loans

- Need-based grants and scholarships

Middlebury is unique in that we only deal with need-based financial assistance, so we don’t offer any merit awards for academics, athletics or extracurricular activities.

2. What does the financial aid process look like?

Tom: I’ll preface this by saying the process varies from school to school.

At Johns Hopkins, we ask students who are eligible to file the FAFSA to submit that form. It’s available on October 1st each year for the following year. Right now, students are filling out the FAFSA for the 2023-2024 academic year. As Mike said earlier, this allows students to access federal student aid.

Like many other colleges and universities, we also ask students to complete the CSS Profile. This form collects additional information about a family’s finances and allows schools to estimate what a family can afford to pay for one year of college. From there, we can determine whether the student qualifies for need-based grants from the school.

Some families may ask, “Do we have to do both forms?” The short answer is yes because the CSS Profile is really a tool that assesses a family’s financial strength. It’s based on sound economic principals, such as consumer expenditure data that’s updated every year, and it makes reasonable assumptions about a family’s ability to pay for college. For example, if a family includes precollege aged children, it’s assumed that some of the parents’ earnings would be saved for their college education too.

All the information sent to the financial aid office is used to come up with an assessment of what we think a family can afford to pay for one year of educational expenses. We take that and compare it against the cost of attendance to determine a family’s financial need.

3. Why are financial aid deadlines important?

Tom: Deadlines vary by institution, but in my experience, the deadlines for financial aid are created so that students receive their financial aid offer as soon as they’re admitted. That’s what drives the deadlines at Johns Hopkins. Ideally, we’re presenting families with all the information they need to make an informed decision about enrolling.

Mike: It’s important for students and their families to track financial aid deadlines, available on each college’s website. At Middlebury, like Johns Hopkins, we are structured with deadlines, but for other colleges things might be different, especially if they work off rolling admissions.

4. What should families do when their own finances change?

Tom: At Johns Hopkins, we want to know as soon as possible about any special circumstances that impact a family’s ability to pay for college.

We hear about all types of situations, like unforeseen medical expenses, a parent falling ill and unable to work, and families caring for elderly grandparents. This happens because families are applying for financial aid with income information from two years prior. 2021 income might not reflect what 2022 looks like or what next year will be.

We recommend families let us know about special circumstance even before they’ve heard about admission.

Mike: I’ll add not every school has the ability or wiggle room to work with families in the pre-admission phase. Some schools may have to stick to whatever the initial aid offer is based on budgetary limitations. At Middlebury, like Johns Hopkins, we’re fortunate enough to be able to meet the student’s need, and we work with families to do that.

With special circumstances, however, timing can be an issue. We like to deal with concrete information and that usually comes from tax returns. For a student applying early decision, it might be hard to do something in December when that year’s tax return cannot be filed until January.

Right now, we’re fully committed to work with that family into the spring once they’ve done their 2022 taxes, but they will have to be patient with us. If a student has special circumstances, it’s easier to apply regular decision.

5. How can families prepare for financial aid in junior year of high school?

Mike: For younger students and their families, we always recommend using a net price calculator or quick cost estimator. Many large state schools will have a basic federal calculator, but schools like Middlebury and Johns Hopkins provide calculators tailored to how we do things, how we collect information, and how we evaluate financial need.

Tom: As early as junior year, families should start talking about financial fit. As you look at those net price calculator results for each college, decide if they’re in line with what you’re able to pay. And if you need to take out loans, how much are you willing to borrow? It’s better to figure these things out early and not wait until your student has to decide where to enroll.

6. Any last words of advice?

Mike: Be open to communicating with the schools that you’re interested in. Every family has something different going on. It’s helpful for us to hear about those unique situations since they don’t always turn up during the application process. We understand talking finances is a sensitive subject but just be proactive. We want to make college affordable for our families.

Tom: Reach out to the financial aid office with questions. I promise the staff is there to help and answer your questions. We would rather you contact us than make any assumptions that could be wrong. And again, take advantage of net price calculators and discuss financial fit as a family.