Most of us start the college search with the fun filters, like location, size, and a major that lights your kid up. Keep those. But add one more lens that saves headaches later: money. Not sticker price. Your price. What you’ll actually pay after scholarships, what might still be left, and what repayment could feel like after graduation.

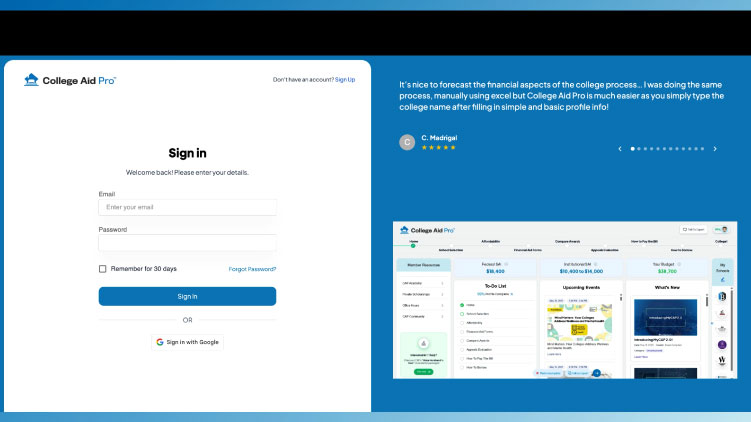

That’s the lens MyCAP by College Aid Pro gives you. It’s more than a search tool or a calculator. It shows your real cost, what you’d still need to cover, how financial aid offers stack up, whether to ask for a better offer (an appeal), and what monthly loan payments could look like, so your dollars and your dreams both get a say.

The views and opinions expressed in this video are those of College Aid Pro and do not necessarily reflect the views of CollegeWell.

MyCAP

What it does, start to finish

- Add your student and schools. Create a profile and drop in some colleges you’re curious about.

- See your real price. MyCAP estimates what you’d pay after scholarships and grants. It also shows what costs might be left to cover (your gap).

- Get a clear affordability label. Each school lands in a simple borrowing bucket (from no loans to higher-risk borrowing), so you can spot safer financial choices at a glance.

- Know your forms and deadlines. Every college on your list is tagged FAFSA and/or CSS Profile, with line-by-line guides so you can fill them out without guessing.

- Upload offers and compare. When award letters arrive, MyCAP standardizes them, so free money vs. loans is crystal clear, and suggests if an appeal is worth trying.

- Build the “how we’ll pay” plan. Line up what you have, what the school gives, and what’s left. Use sliders to test 10- vs. 25-year loans, small parent help, and see a real monthly payment.

- Keep scholarships in play. See likely awards from each college and search private scholarships you can actually apply to.

That’s the whole arc, from the first list to “we can pay this without panic.”

Why the usual search misses the mark

College search tools are great at sorting by location, size, and majors. What they don’t show well is the money that matters to you:

- Net price: sticker price minus grants and scholarships you don’t pay back

- Funding gap: what’s left after aid and your planned family contribution

- Early-career pay: a reality check of what a first-year salary might look like for a likely major from a specific school

MyCAP adds those filters so you’re not guessing. You can see, for each school on your list, whether the numbers whisper “green light” or blink yellow.

A quick story

When Maya and her dad built a list the first time, they had fifteen schools and zero idea what any of them would actually cost their family. Then they dropped those schools into MyCAP. Same list, new lens. Four schools shifted to the top because the net prices were friendlier than the sticker suggested. Two “dreams” stayed on the list but got an honest tag of caution because they would have to borrow quite a bit of money to make it happen. They didn’t toss those schools; they just walked in with open eyes and a plan.

The four borrowing buckets

Plain English, no judgement

Loans aren’t evil; they’re a tool. MyCAP color-codes each school by a simple set of guardrails:

- (Green) Ideal = No loans

Grants, scholarships, savings, and payment plans cover the bill. - (Light Green) Great = Loans within the $27,000 Federal Direct Student Loan limit

Dependent undergrads can borrow up to $27,000 total over four years in Federal Direct Student Loans (the student’s own loans). Staying at or under this keeps many grads in a manageable monthly range. - (Orange) Good = Total student borrowing < first-year salary

If projected early-career pay is $48,000, try to keep total student loans below $48,000. It’s a simple gut check that helps the future-you breathe. - (Red) Caution = Borrowing > first-year salary

This is your flashing yellow light. Not an automatic “no,” but it calls for a real conversation about repayment, parent loans, and tradeoffs.

You’ll see which bucket each school lands in before you spend weekends on campus tours.

Forms

What you need and how to do them, without the midnight panic

Two acronyms, lots of confusion:

- FAFSA: the federal aid form most schools use

- CSS Profile: an extra form some private colleges require

Inside MyCAP, every school on your list is tagged with the forms it needs. There are line-by-line guides (yes, literally) so “assets” and “household size” don’t turn into guesswork.

Offers arrive

Now compare apples to apples, and appeal if needed

Spring hits and award letters start showing up, all formatted differently. MyCAP lets you upload those letters, standardizes them, and highlights what matters:

- Grants vs. scholarships vs. loans (no more blended “aid” that hides borrowing)

- One-time vs. renewable awards

- Work-study (great, but not guaranteed hours)

If the offer seems light, consider an appeal, a respectful request for review. Good reasons include a better offer from a peer school, a change in income, medical expenses, or anything the first form didn’t capture. MyCAP helps you weigh your case so you can draft a straightforward plan instead of winging it.

Scholarships

Both kinds, one plan

You might’ve read my last post about private scholarships (the small ones add up!). MyCAP keeps scholarships in view on two fronts:

- Institutional scholarships – See what a school historically offers and what you might expect. If a slightly higher test score bumps you into a better tier, that’s visible — so you can decide if a retake is worth it.

- Private/outside scholarships – Search and sort curated data

“How do we actually pay the bill?”

This is where the headaches usually start. MyCAP lays out, side by side:

- What you have: 529 plans, savings, monthly cash flow

- What the school gives: grants, scholarships, work-study

- What’s left: your cost gap

Then you can play with interactive graphs and calculators: 10-year vs. 25-year repayment, interest over time, what happens if parents add a small monthly contribution, how a small scholarship changes the payment. It’s a reality preview — before anything is final.

Common gotchas to sidestep

- Sticker price ≠ net price. Run your numbers; averages can mislead.

- Year 1 isn’t the whole story. Confirm which scholarships renew and what GPA is required.

- “Aid” can include loans. Separate free money from borrowed money.

- Work-study isn’t guaranteed hours. Treat it as potential, not certain cash.

- Parent loans ≠ student loans. Terms, protections, and who’s on the hook differ.

A gentle nudge

Fit matters. So does cost. You don’t have to choose between them. Put dollars and dreams on the same page, and decisions get calmer, kinder, and a lot more confident.

If you try one thing this week, make it this: create your MyCAP account, add one school, and see what your net price could be. In less than 10 minutes you could see your possibilities differently — in a good way.

The services mentioned in this article are shared for informational purposes only and do not imply an endorsement by CollegeWell.