When people talk about college financial aid, the FAFSA gets most of the attention. And rightfully so – it’s required by every college and university. However, many private institutions also require another form called the CSS Profile.

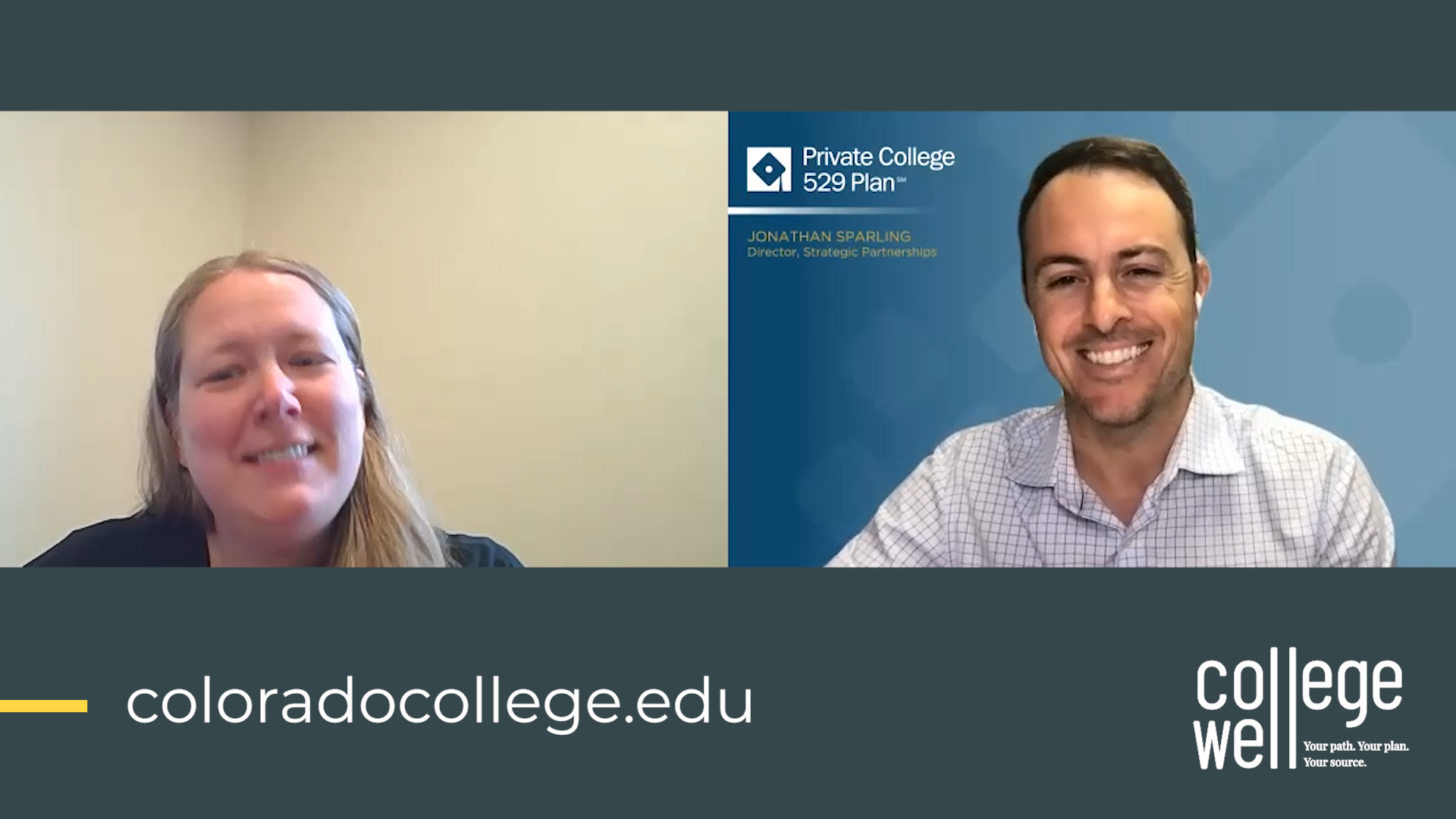

Shannon Amundson, director of financial aid at Colorado College, joins our Learn from the Experts series. Shannon reviews the CSS Profile and discusses how colleges use this form to make informed decisions.

A closer look

Compared to the FAFSA, the CSS Profile takes a deeper dive into a family’s finances. As Shannon notes, the form was designed to be rooted in economic principals, factoring in all types of income and also asking about large expenses, like medical or housing.

More questions, greater clarity

“We want to be able to use our resources — which are still limited — to help as many families as we can, and treat as many families as we can equitably,” says Shannon. “We ask more questions about your expenses [which are] designed to really let us see a full picture of what a family is bringing in and what’s going out.”

And that’s one of the main reasons colleges choose to use the CSS Profile. When a college understands a family’s full financial picture, it can make a more informed decision about institutional aid.

Come prepared

If it’s your first time completing the CSS Profile, Shannon advises you to come prepared.

“Make sure you have the tax forms for the year that they’re asking for, and make sure that you have your full tax return, not just the first page,” says Shannon.

Additional items to have on hand:

- W2s to match the tax return

- Investment/bank account statements

- Information on rental properties and second homes

One form, multiple results

After completing the CSS Profile, colleges will review the information and determine your financial eligibility. When reviewing the data, each college will treat the information differently.

“That’s the benefit to the CSS Profile for the schools,” says Shannon. “We can put our priorities where we want them.” For example, some colleges may choose to include retirement savings or all the equity in a second property as a financial resource for college. Others will not.

“That’s why you’ll get packages from some schools that are vastly different,” says Shannon. “—Even though you submitted the same information. It’s simply because [schools] choose to look at it differently, so that’s important to note.”

Ask for help

“We’d much rather answer questions, so don’t hesitate to reach out,” says Shannon. Completing the CSS Profile — especially the first time — may be overwhelming. Colleges are there to help you, but you need to ask.