Someday, your student will be past all the paperwork, deadlines, and waiting – and they’ll have college acceptances in the palm of their hand (or at least sitting in their inbox). For a moment, the work will feel done but not so fast. Your student will still need to make the big decision.

With so much to consider and options to weigh, the decision can be tough — even when money is the deciding factor. Cue the financial award letter. You’ll get one from each college after the required applications are in and your student is accepted, but don’t expect the letters to look alike.

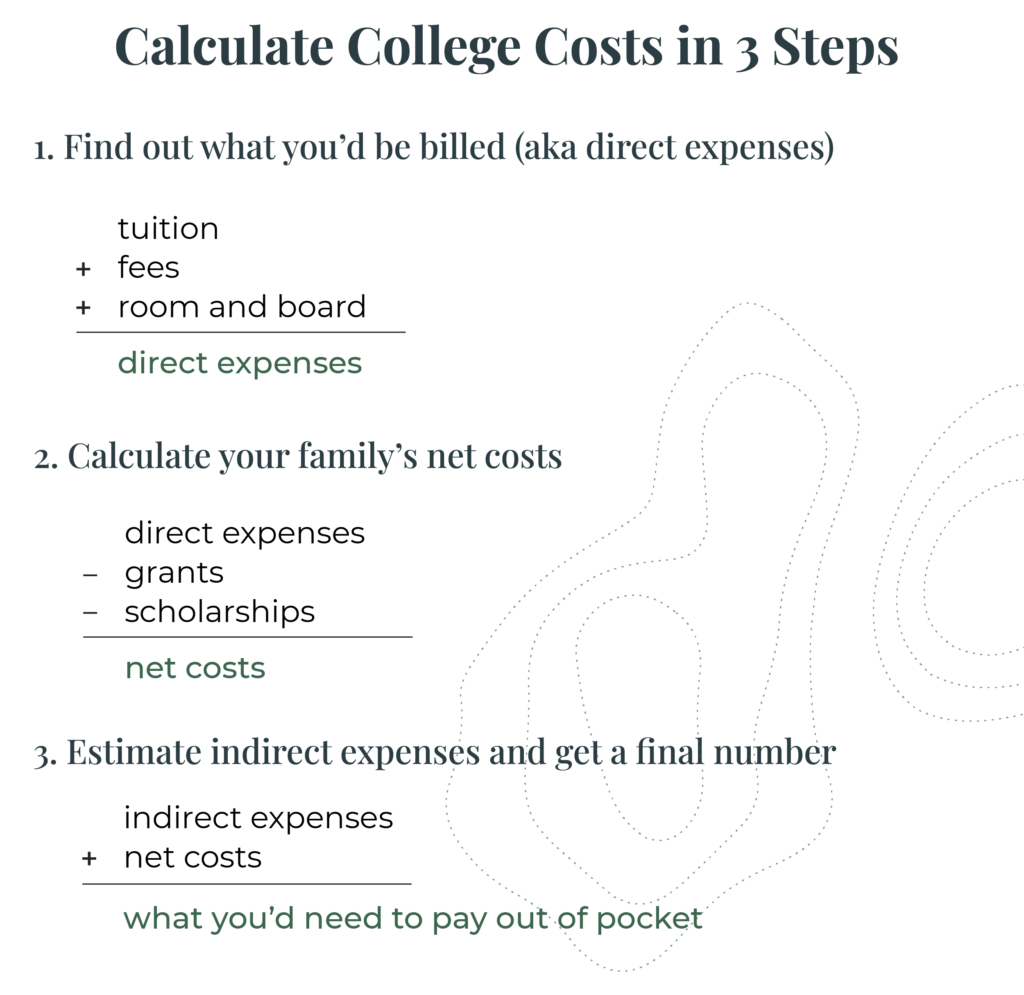

Though an apples-to-apples comparison might be hard, you can always calculate college costs on your own. All it takes is a little organization, a single spreadsheet, and three steps.

Step 1. Find out what you’d be billed (aka direct expenses)

Take your financial award letter and find the college’s direct expenses (what they’ll bill you for) under “cost of attendance” (COA). These expenses include tuition, fees, and campus room and board.

Other things like books and supplies might be listed under the COA, but they’re considered indirect expenses since they’re not billed by the college. More on that later.

Tip: Many colleges include their student health insurance on the bill. If a student will be covered under a separate, comparable plan for the year, make sure to complete the college’s waiver by the deadline. Otherwise, you may get stuck with the charges.

Step 2. Calculate your family’s net costs

Now take the college’s direct expenses and subtract any grants and scholarships (the free money that doesn’t have to be repaid). This leaves you with your family’s “net cost.” If your student enrolled at the college, this number should match the actual bill.

Though there can be other types of financial assistance on the award letter, like loans and work-study, don’t include them in this step. We’re only looking at free money here. It’s the best way to accurately compare your out-of-pocket costs for several colleges.

Tip: If scholarships are included in the financial award letter, understand their renewal requirements. Does the student need to maintain a certain GPA? Do they have to remain in a specific program of study? If they don’t retain the scholarship, what does that do to your bottom line?

Step 3. Estimate indirect expenses and get a final number

Now that you’ve listed out direct expenses and calculated your student’s balance for each college, it’s time to estimate all the other costs that go into college life – like books and supplies, transportation, and spending money. These are considered indirect expenses since they don’t show up on the college bill. To the best of your ability, estimate what they’ll be for each college and add them to the net. This will give you an “all in” cost for the year.

Tip: Get imaginative and think about how each expense might differ from college to college. Transportation is an easy place to start. If a college is close to home and your student is living on campus, you might just be spending money on a monthly bus or subway pass. Whereas a college far from home could require your student to buy airfare several times a year.

Once you’re done filling out the spreadsheet — and getting closer to a decision — plan on how you will meet expenses for the duration of college, not just freshman year. Have you saved in a 529 plan? Is there an interest-free payment plan available? Before borrowing loans through the financial aid package, consider other options that cost less.

Look here for tips on using 529 funds to pay the bill.