You planned, you saved, and now you may have questions about using your 529 funds.

First, congratulations!

As a former financial aid administrator, I’ve seen how relieved families are when they realize their years of saving for college pay off. Saving can mean your child gets to attend the college of their dreams. And it’s less borrowing for you both, giving your child a financial leg up after they graduate.

One study shows the average college savings for families with children nearing college is $22,985.* That might not cover the full cost. But think about it this way: if you had to borrow $22,985, it could cost you thousands more with interest to pay off the loan.

Do you have young kids? Save as much as you can. Every dollar helps. And save as early as you can. Let interest work for you.

Ready to use your 529 funds? Hold on.

You are in control of your 529 funds and when and how you use them. Still, there are many factors to consider: the types of 529 plans you own, qualified expenses, grants and scholarships, and limits on tax and penalty-free withdrawals. Even current financial markets can play a factor.

Have multiple 529 plans? Smart.

Saving in both a prepaid and traditional 529 savings plan is a good strategy. It maximizes tax benefits and protects you against market volatility.

Take a crash course on both plans >>

Prepaid 529 plans are usually designed to cover tuition and mandatory fees, where 529 savings plans can also cover room and board, books and supplies, and other educational expenses. You can usually redeem up to the full tuition and fees amount per term at colleges that participate in the prepaid plan. You can use distributions from both plans to cover additional qualified education expenses, but for the most value, the prepaid plan is best for tuition and fees.

Your child got a scholarship? Congrats!

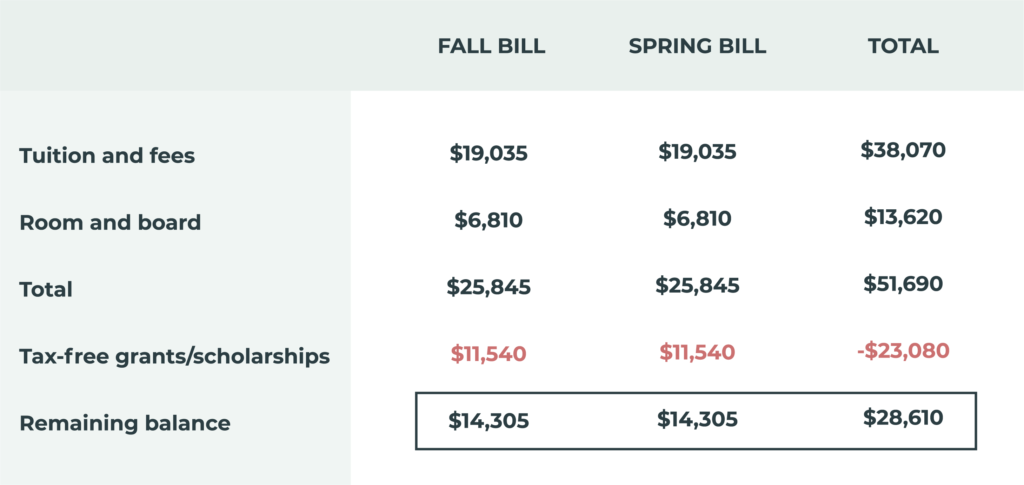

This means your savings can go even further. Luckily, most families don’t pay the full price for college. For students at private colleges in 2021-2022, the average bottom line was $28,610.**

If you don’t use all your savings because of a scholarship, you have options for your remaining 529 funds. You can assign the money to an eligible family member, like one of your other kids, or use the funds for K-12 tuition. You can also use a portion to repay student loans, or you can hold on to the funds for graduate school. For a prepaid plan, you can roll the assets into a 529 savings plan for any qualified education expenses listed above.

Want to avoid taxes and penalties? Of course.

As mentioned, you can use 529 funds for qualified education expenses — federal tax-free! Just keep these things in mind:

The basics

To qualify for tax-free distributions, the amount you withdraw from your 529 shouldn’t exceed the amount you have to pay: the college bill and a few related expenses, minus any grants and scholarships. For families who claim an education tax credit, you must also deduct costs used to determine eligibility for the credit. In other words, no double dipping on federal tax benefits. This requires some planning.

The details

Calculate how much you can withdraw without paying taxes and penalties:

First, add up all qualified expenses that you paid in the current tax year. This can include tuition, mandatory fees, room and board (if the student is at least half time), books, and certain equipment like a laptop. If the student is living off campus, you can generally include the room and board amount or living allowance the college uses to determine your cost of attendance for financial aid purposes.

Next, subtract your non-taxable scholarships, federal grants, tax-free tuition discounts, like employer assistance programs, and college expenses used to calculate eligibility for the American Opportunity Tax Credit or Lifetime Learning Credit.

The remaining amount is the max you can withdraw tax and penalty-free from your 529.

You can also use your 529 savings to pay up to $10,000 per year for K-12 tuition or pay off student loans up to $10,000 for yourself or kids. About 40 states recognize these uses as qualified distributions for state tax purposes. So, check with your state’s rules.

If your withdrawal exceeds these amounts or is used for non-qualified expenses, like student health insurance or transportation costs, the earnings portion of the distribution is taxed as income plus a 10% penalty. However, the 10% penalty can be waived for non-qualified distributions up to the amount of the scholarship.

Ready to see an example? Keep reading.

Your child gets into their top choice private college, and the bill is $51,690 the first year.*** Grants and scholarships total $23,080, reducing the college bill to $28,610 for the year. And this final amount is called the net cost.

Over the years, you put away money in both types of 529 plans.

Let’s say the current value of your 529 savings plan is $20,000, and you own 1/3 of annual tuition and fees in your prepaid plan, currently valued at $11,421 based on the college’s current tuition and fees.

You could pay the full remaining balance with distributions from both plans: $11,421 from your prepaid 529 and $17,189 from your 529 savings, leaving $2,811 in the account for next year.

But would withdrawals be tax-free? Depends.

Let’s say your child’s college charges the first half of tuition in July and the second half in December — $25,845 per semester. Payments for both bills would count as eligible expenses in the tax year if they’re made before December 31. In September, you also paid $600 for books and $2,000 for your child’s laptop. That brings your qualified expenses for the tax year to $54,290.

Your grants and scholarships ($23,080) reduce your $54,290 qualified education expenses to $31,210.

Since the college reduced your bill by the amount of your scholarships, you already factored those in when taking your distributions. Your plan distributions ($28,610) are less than the amount you are qualified to take without incurring a tax penalty ($31,210).

So far so good.

However, if you claim the maximum American Opportunity Tax Credit of $2,500 in the same tax year, you also need to subtract $4,000 of your qualified expenses that were “used” to calculate the credit, bringing your $31,210 in eligible expenses to $27,210. Now you have exceeded your qualified distributions by $1,400, and the earnings portion of that additional amount would be subject to federal income tax.

You could likely avoid the additional 10% penalty because of the scholarship provision mentioned earlier. You may find it’s to your financial advantage to still take the tax credit, or you may want to plan ahead and reduce your 529 plan distributions accordingly.

This is a good time to speak to a tax professional.

Have you thought of everything? Almost.

You may decide it’s best to spread the funds over multiple years. If your 529 savings took a dip because of the financial markets, you may opt to hold on to a larger portion and give the funds time to climb back. On the other hand, if you don’t have wiggle room in your budget to cover remaining costs and need to borrow to make ends meet, using your 529 funds in the earlier years to delay interest accruing on student loans may be a smart choice. All these decisions need to factor in current market performance and loan interest rates.

If you have a generous parent or another relative that opened a 529 account for your child, you will need to coordinate who is taking the lead on paying the bill (and how much). As of the 2024-2025 FAFSA, distributions from non-parent owned 529 plans are no longer counted as student income. That’s great news for families, but you will still want to discuss how your relative’s 529 savings fit into the total financial picture.

Consulting a financial advisor or tax professional is never a bad idea when it comes to your family’s finances. I always learn something new when I talk to mine.

*SallieMae, How America Saves for College, 2018 https://www.salliemae.com/content/dam/slm/Media/images/Research/HAS2018_Full_Report.pdf

**College Board, Trends in College Pricing 2021 https://research.collegeboard.org/media/pdf/trends-college-pricing-student-aid-2021.pdf

***Includes tuition, fees, & room and board