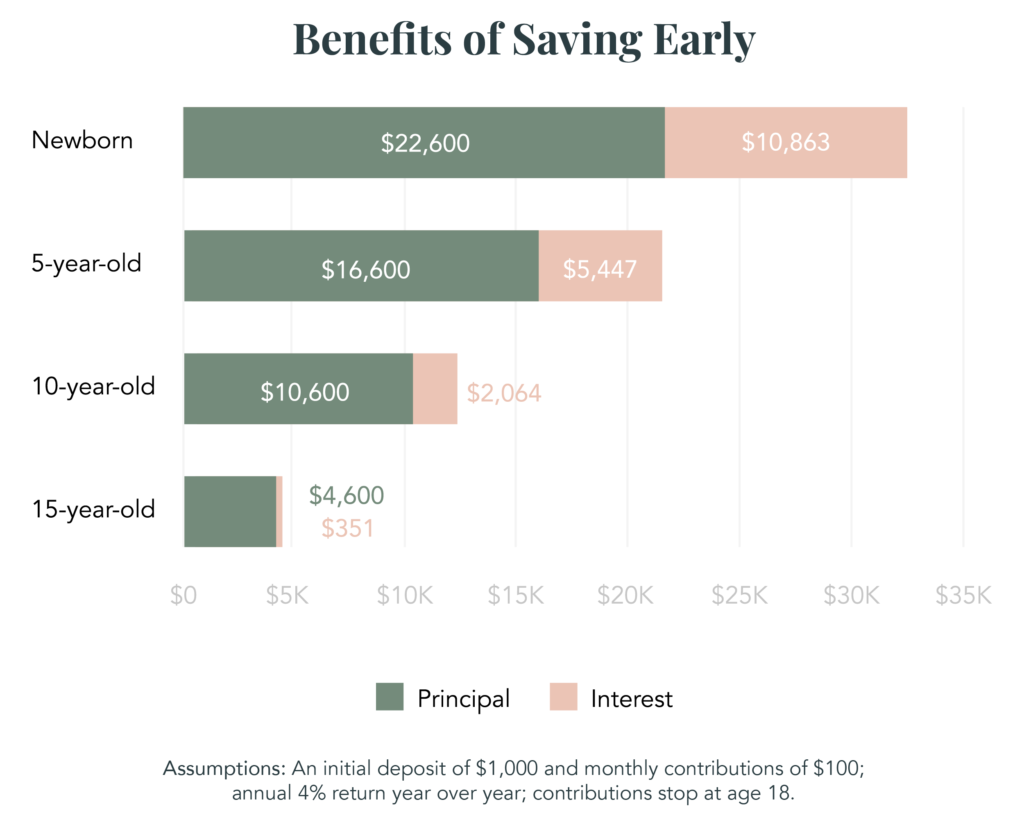

Whether it’s saving for college, retirement, or a 10-year family reunion, time is on your side. If seeing is believing, see below!

Let’s say you open a college savings account with an initial deposit of $1,000. If you make monthly contributions of $100, and assuming an annual return of 4% per year, your savings can really add up.

More time means more opportunity

As our saving chart confirms, the earlier you start saving, the bigger the payoff. Stashing away money for your newborn could mean you save twice as much — if not more — because the interest earned on your savings also grows interest. And assuming you are saving in a 529 plan, that money grows tax-deferred.

Of course, as with any investment, returns are not guaranteed. However, the earlier you start investing, the more time you have to recoup losses from any down years — another win when you start early.

What if I can’t spare $100 per month?

Any amount helps. Remember, most families cover college costs with a combination of savings, income, and loans — sometimes referred to as the past, present, and future approach. Be realistic with your college savings goals. Aim high, but don’t aim so high that you give up halfway through.

Open. Save. Repeat.

You can’t start until you open an account. You won’t save until you contribute. And you won’t see growth until you contribute repeatedly. So, make sure you take all these steps one right after the other.

It’s easy to put off saving by telling yourself, “I’ll do it next month.” Take choice out of the equation. Automate your contributions and watch your savings grow.