Amy Irvine knows better than anyone that life throws curveballs and plans can change. As a Certified Financial Planner at her own firm, she helps clients make decisions with enough wiggle room for life’s “what ifs.” And saving for college is no exception.

Families saving for college in a 529 plan often ask Amy, “What if my child doesn’t go to college?” Thankfully, 529s are not a “use it for college or lose it” type of savings plan. There’s enough flexibility built in to ensure your money isn’t lost.

In this video, Amy addresses the biggest “what if” of all.

Myth: If my child doesn’t go to college, I’ll lose the money.

“Many people have this misconception,” says Amy. “That if they save in a 529 plan for their child, grandchild, niece or nephew, and for some reason they don’t need the money, they won’t be able to use it. But that’s simply not true.”

What can I do with the money if my child doesn’t go to college?

Good news, you have options. Amy shares five common ways to still access money in a 529 plan:

- Pay off student loans. Up to $10,000 can pay down student loan debt.

- Pay for trade school. If your child is more interested in pursuing education through a cosmetology, culinary, or technical school, for instance, a 529 can now be used for those programs.

- Fund another education. You can transfer a 529 to another child or eligible family member without tax consequences.

- Withdraw it. If your child is awarded a scholarship, you can still make non-qualified withdrawals up to the scholarship amount without any penalty. Only the earnings portion is taxed.

- Have a prepaid plan? Not a problem. You can still get money out; the return just won’t be great.

How can I get started?

Amy has a few suggestions:

- Talk to a financial planner. “I will admit, I’m completely prejudiced,” confesses Amy. “But I think working with a financial planner is the first action step because there are so many avenues you can go down.”

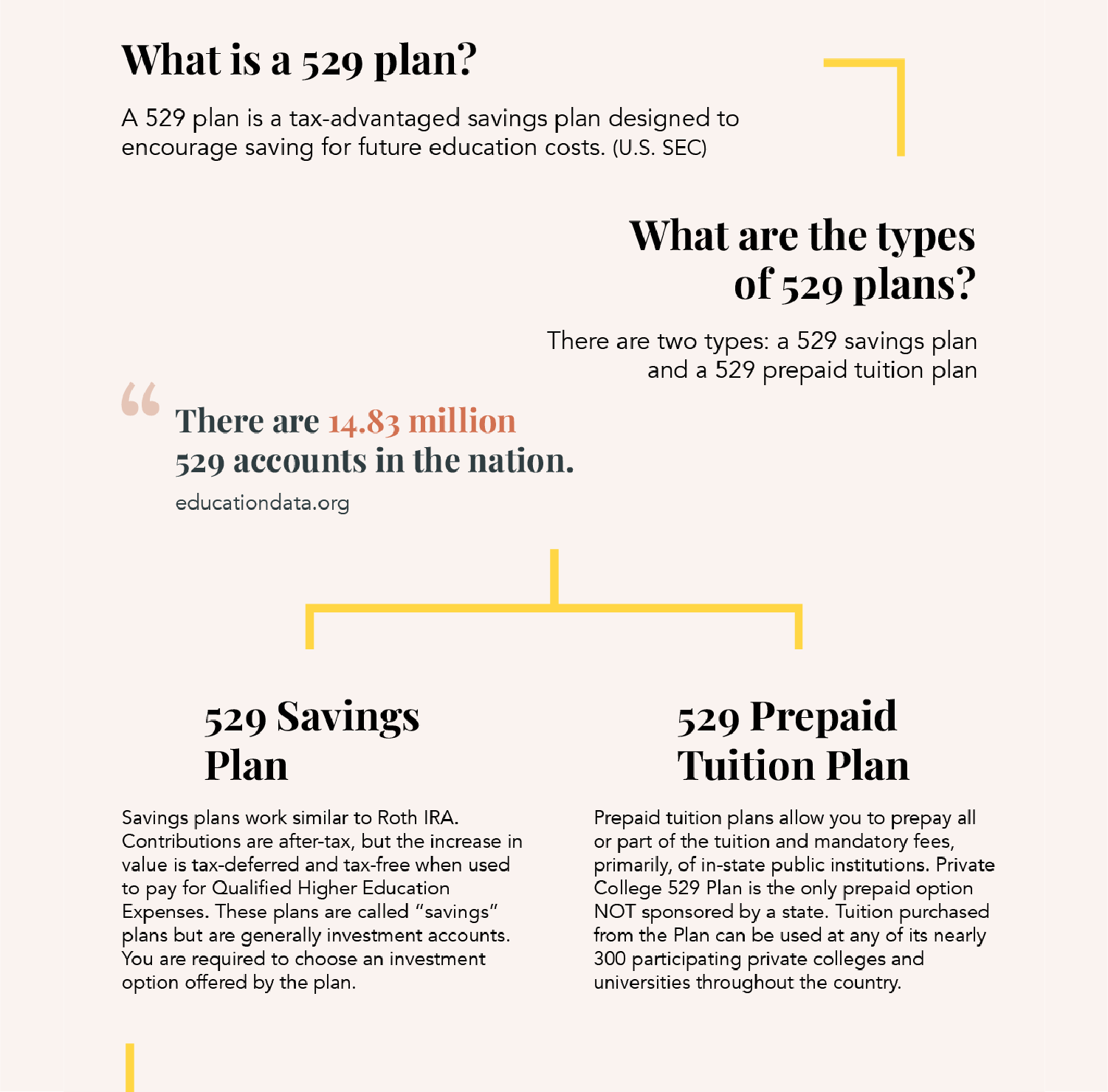

- Make a decision — or two. Should you save in a private 529 plan? A state 529 plan? A combination of both?

- Automate. Once you determine how you will save your money and how much, the next step is automation. It’s the best way to ensure your savings grow.

See another of Amy’s 529-myth-busting videos >>