If your family is anything like mine, dinner conversation turns to finance talk midway through the meal. After my dad asks if I need money (mind you, I’m nearly 40), he naturally asks about the grandkids — ages 6, 6 and 10. And that lands us on the importance of saving, investing, and planning for college.

Today I can have a good conversation with my dad about 529 plans, but that wasn’t always the case. Everyone has to start somewhere — for me, it was with the basic question, “What’s a 529?”

Looking to start somewhere yourself? We cover the basics right here.

If you don’t know exactly what a 529 plan is, don’t worry, 64% of parents don’t either.

A fresh start

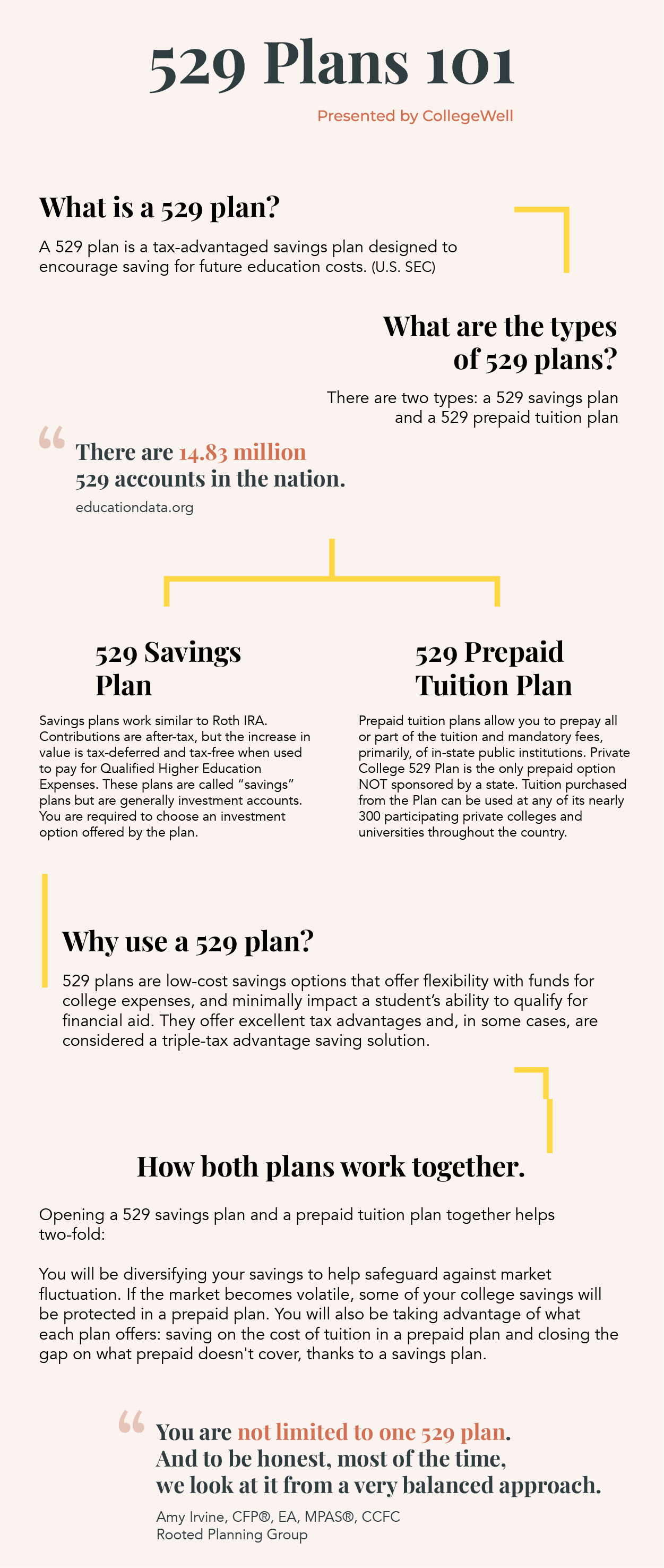

529s always pop up when talking about saving for college. Articles are written about them, experts are interviewed on them, and family members ask about them. If you don’t know exactly what a 529 plan is, don’t worry, 64% of parents don’t either. But that can change right now!

529 plans are a powerful way to save for college. And more families need to understand what they are and how they work.

Use this page as an introduction to 529s to find out:

- What makes a savings plan a 529.

- What falls under the 529 umbrella.

- Why even use a 529 plan to save for college.

- How one 529 plan can complement the other.

Get started.

Where to go next

This was just the start.

- Take an intermediate look at both plans.

- Learn about your state’s 529 savings plan.

- See why Private College 529 Plan is a unique prepaid option.

Making the best decision for your family doesn’t have to happen overnight. Take the time to do the research, ask your questions, and land on a plan that’s right for you.

Feeling confident is more important than jumping into anything fast. We’re here to help you get on the right path with the right footing.